Prices increased at the fastest rate in more than three decades in October, as energy costs rose, supply chains remained under pressure, and rents rose. This is alarming news for economic officials at the Federal Reserve and the Biden White House, who are trying to keep inflation under control.

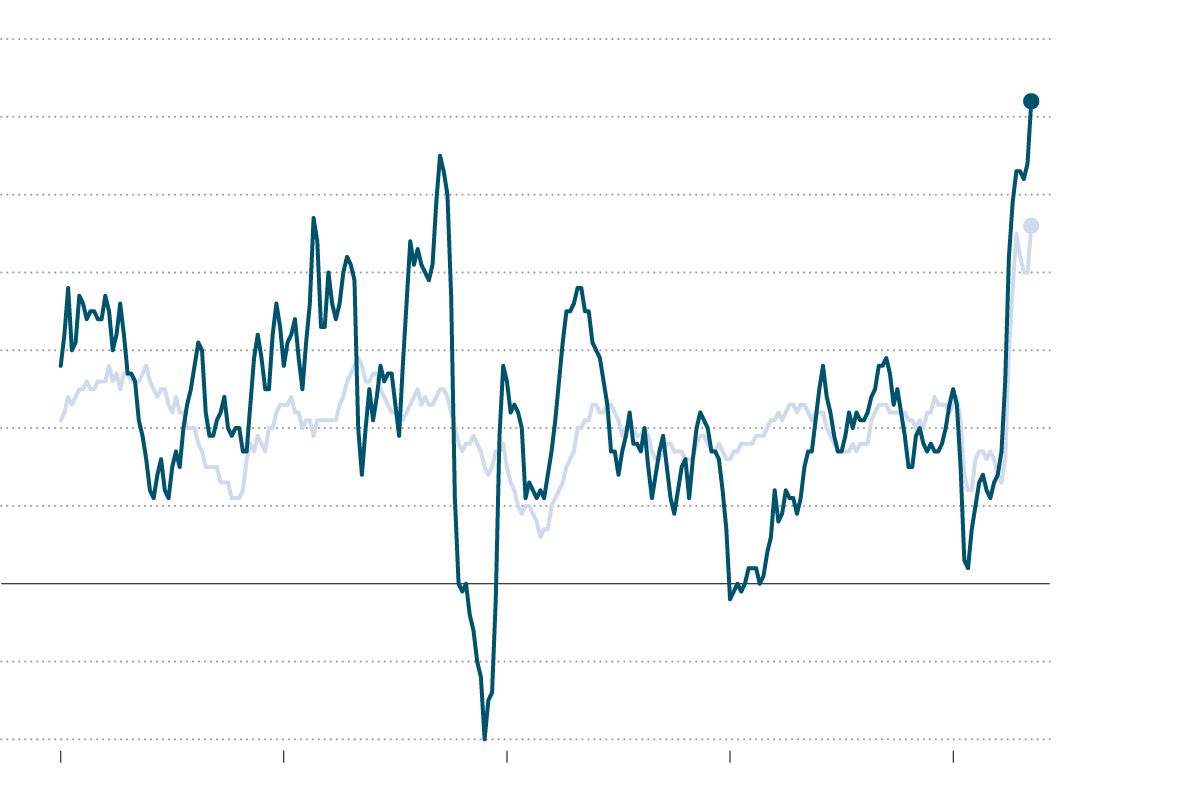

Price growth in the aggregate increased by 6.2 percent over the last 12 months, the greatest rate of growth since 1990, and monthly inflation started to rise again.

Prices increased across the board in October, including at deli shops, restaurants, and auto dealerships, among other places. The increase is an unsettling news for the Biden administration, which had repeatedly said that although price hikes were quicker than typical, they were slowing down from the rapid readings seen over the summer months. It also represents a policy problem for the Federal Reserve, which is tasked with preserving price stability while encouraging maximum employment.

President Biden addressed the growing expense of living on Wednesday, making a statement shortly after the report was released, in which he said that “reversing this trend is a high priority for me.”

Consumers are feeling the squeeze as petrol, grocery, and housing costs continue to rise. The president’s popularity ratings have dipped as a result. The growing costs may also make it more difficult for him to get a substantial spending measure through Congress that includes much of his economic agenda, since some members of Congress have expressed worry about the effect that increased government spending may have on the inflation rate.

It is true that inflation is not slowing down as many economists had said it would by the end of 2021, but this is just one of the problem. Instead, it increased by 0.9 percent from September to October, according to a Labor Department report, which was quicker than the preceding month’s growth of 0.4 percent and far more than experts’ projections. Prices for so-called core commodities, which exclude items such as food and gasoline, have also risen at a faster rate.

Administration and Federal Reserve officials have both insisted that fast inflation would ultimately subside in the future. However, they have had to modify their estimates of how rapidly that would occur: Supply chains continue to be severely knotted, and demand for products is maintaining steady, which is contributing to the rise in costs. As salaries begin to increase in many industries as a result of labour shortages, there are grounds to believe that some firms may charge their consumers higher prices in order to pay rising worker expenses. The statistics released in October did little to soothe the mounting feeling of anxiety.

The fact that inflation is expanding beyond pandemic-affected categories such as imported goods and airline tickets to slower-moving ones such as rent may raise concern among Fed officials since it increases the likelihood that pricing pressures will persist. This is particularly true at a time when labour is scarce and participation in the labour market shows no signs of improving, according to Ms. Meyer, which is pushing pay increases.

Officials have refrained from responding to a spike in inflation caused by supply chain difficulties, fearing that doing so may have an unintended negative impact on the economy. If the current trends continue, the Federal Reserve will most certainly face increasing pressure to accelerate its plans to reduce economic assistance by halting their stimulus-inducing bond-buying programme and hiking interest rates from rock-bottom levels sooner and more aggressively.

The inflation data were taken into consideration by the markets, which resulted in equities gradually declining during the day. This indicates that investors predicted inflation to average roughly 3 percent a year for the following five years, which is much greater than any point in the decade before to the pandemic’s outbreak.

It is impossible to forecast when price spikes will begin to level out, which is problematic for both regulators and investors. Numerous firms have reopened as a result of state and municipal lockdowns designed to limit the coronavirus. The economy has never seen such a wide-scale closure and restart.

Several central bank officials, notably Richard H. Clarida, vice chairman of the Federal Reserve, have said that key indicators of price expectations have not yet entered the danger zone. Furthermore, there are still grounds to anticipate that today’s price spike will be short-lived. Homes are sitting on large savings nest eggs gathered during the epidemic, but they should presumably spend them down now that government assistance programmes like as enhanced unemployment insurance have been phased out completely or mostly in most cases.

Some officials at the Federal Reserve have already expressed concern that the central bank may need to withdraw economic assistance sooner rather than later. While doing so may lower prices by reducing demand, it would also damage the job market since millions of people are still out of work as compared to pre-pandemic employment levels, which would be detrimental to the economy.