A new coronavirus variant discovered in South Africa prompted another round of travel restrictions and reignited concerns about the economic toll that the pandemic will have on the world economy on Friday. Stock markets around the world fell, and oil prices plummeted as a result of the discovery of a new coronavirus variant.

On Friday, the S&P 500 saw its worst day since February as a rising number of countries, including the United States, pushed to bar travel from a group of around a dozen African countries. The uncertainty rattled a stock market that had been functioning well, and market observers predicted that the increased volatility would persist while governments evaluated the dangers of the variation.

As a result of the large number of mutations found in this new form, there is concern that it might be particularly infectious and make existing immunizations ineffective. Scientists, on the other hand, have not reached any definite findings as of yet.

For Kiran Ganesh, a strategist at UBS Global Wealth Management, “the market’s precipitous decline is a consequence of both ‘yeah, this is awful news,’ as well as the reality that we have been on a really great run with relatively minimal volatility for quite some time.” “It’s still too early to tell what this variety is going to accomplish,” says the researcher.

The S&P 500 finished 2.3 percent down, while the Nasdaq composite index finished 2.2 percent lower as a result of the decline. The stock markets in Europe plunged by 3 to 5 percent.

The financial markets in the United States were closed on Thursday and closed early on Friday in observance of the Thanksgiving holiday. Because of the holidays, traders may be less active, which might increase the volatility.

The fall on Friday pushed the benchmark S&P 500 index even farther away from a record high hit just a few days before. Investors have been obsessed with increasing prices and concerns that central banks may remove support to battle inflation as a result of supply chain disruptions and shortages of products and employees in certain industries.

However, the appearance of a new variation caused their attention to be drawn back to the basic problems of the pandemic, which they had forgotten about. Because of a fourth wave of the virus in Europe, existing limitations, including certain lockdowns, have already been tightened further.

According to Keith Lerner, a strategist at Truist, “the pandemic and Covid variations remain one of the most significant threats to markets, and they are likely to continue to inject volatility into the market going forward.”

In light of the record highs at which equities have been trading, Mr. Lerner believes a moderate sell-off is not out of the question. “At this time, we are not making any modifications to our investment recommendations,” he stated, adding that consumers and businesses have become considerably more used to coping with viral limitations.

Futures for West Texas Intermediate oil, the benchmark for U.S. crude, fell more than 13 percent to $68.04 a barrel, the lowest price since early September, according to the Energy Information Administration. The price of oil has been particularly sensitive to viral limitations, which have kept people at home for extended periods of time. In only three days, the United States and five other nations launched a concerted effort to draw on their own national oil reserves in a bid to bring increasing gasoline prices down.

European benchmark Brent crude prices plunged by 11 percent to almost $73 a barrel. UBS, however, predicts that the price of a barrel of oil will climb to $90 by March, in part because of the idea that the anxieties about further virus limitations would be transitory, according to Mr. Ganesh.

Demand for government bonds, which are seen to be relatively safe, increased, driving their prices up and their yields down. A 15 basis point, or 0.15 percentage point, reduction in the yield on the 10-year U.S. Treasury bond to 1.48 percent was the greatest one-day decline in the bond’s yield since March 2020. During the week, the yield on Germany’s bund, which serves as the continent’s benchmark bond, decreased by nine basis points to minus 0.34 percent.

Stocks that thrived under lockdowns and quarantines, such as Zoom and Peloton, saw their prices rise in a resemblance to the market oscillations of the previous year. Travel-related companies like as Carnival Cruise Lines and Boeing, a jet manufacturer, suffered losses as a result of the travel restrictions.

In Asia, the Nikkei 225 index in Japan fell 2.5 percent, while the Hang Seng Index in Hong Kong fell 2.7 percent, according to final results.

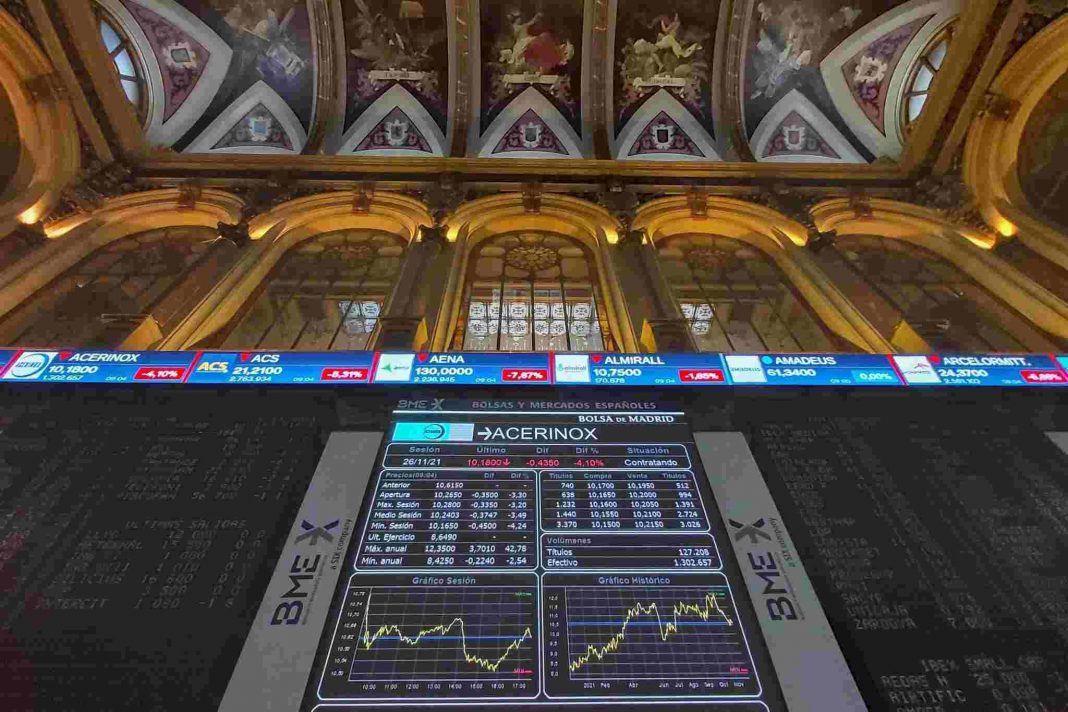

In Europe, energy equities were the driving force behind the market’s decline. The Stoxx Europe 600 index fell by 3.7 percent at the closing. The FTSE 100 index in the United Kingdom sank 3.6 percent, while major stock indices in France and Spain plunged by almost 5 percent.

A reduction in airline stocks occurred after numerous countries, notably the United Kingdom and France, moved to limit flights from South Africa and seven other African countries. IAG, the parent firm of British Airways, had its share price fall by about 15%, the largest decrease in the FTSE 100 index.