The Federal Trade Commission (FTC) gave the green light on Thursday for Exxon Mobil’s acquisition of Pioneer Natural Resources, provided that Pioneer’s chief executive, Scott Sheffield, is excluded from Exxon’s board. This approval paves the way for the $60 billion deal between the two Texas-based companies to potentially finalize as early as this week, creating a dominant force.

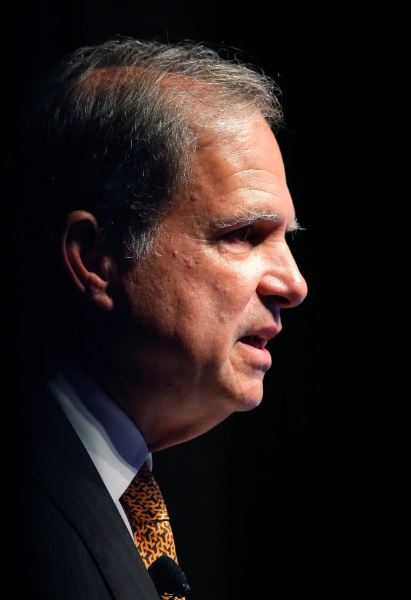

The FTC accused Scott Sheffield of colluding with officials from the Organization of Petroleum Exporting Countries (OPEC) and its allies to manipulate global oil production and prices. Kyle Mach, deputy director of the FTC’s Bureau of Competition, emphasized the necessity of excluding Sheffield from Exxon’s board, citing concerns over unfair pricing practices.

The FTC pointed to Sheffield’s alleged efforts to coordinate oil production across the Permian Basin with OPEC and its allies through public statements, as well as through text messages and personal meetings with other oil executives. The commission highlighted Sheffield’s exchange of “hundreds of text messages” with representatives and officials of the cartel discussing oil market dynamics, prices, and production levels.

Scott Sheffield has been a prominent figure in the U.S. oil industry, notably as an early explorer of shale deposits in Texas. He also played a pivotal role in lobbying federal lawmakers to lift the ban on oil exports, a successful effort during the Obama administration.

In response to the FTC’s conditions, Exxon stated that it had agreed not to appoint Sheffield to its board. The company maintained that the allegations against Sheffield were inconsistent with its business practices. Exxon emphasized its commitment to conducting business ethically and in compliance with regulations.

Pioneer Natural Resources contested the FTC’s accusations, asserting that Sheffield never engaged in collusion with other oil producers. The company expressed surprise at the FTC’s findings and defended Sheffield’s communications as having no intention to circumvent market competition laws. Pioneer highlighted its substantial increase in oil production from 2019 to 2023, which contributed to lowering energy prices in the United States.

Scott Sheffield refrained from providing additional comments beyond Pioneer’s official statement.

Following the FTC’s approval with conditions, shares of both Exxon and Pioneer experienced a modest increase of approximately 1 percent on Thursday morning.

The FTC’s decision underscores the regulatory scrutiny surrounding major acquisitions in the oil and gas industry, particularly concerning potential anti-competitive behavior. With the conditions imposed by the FTC, Exxon Mobil’s acquisition of Pioneer Natural Resources moves forward, albeit with restrictions aimed at addressing concerns over market competition and pricing practices.