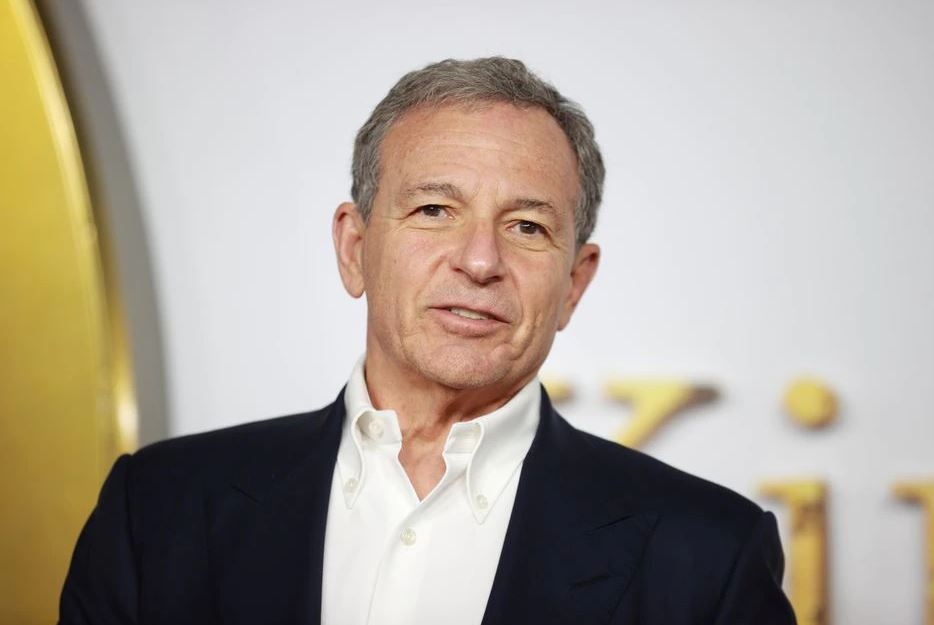

Bob Iger is making a surprising comeback to The Walt Disney Company as chief executive officer less than a year after he retired from the company.

According to a statement released by Disney late on Sunday night, Iger, who is 71 years old and served as chief executive officer for 15 years until retiring from that role one year ago, has agreed to continue as CEO for two additional years beginning immediately. He will take over for Bob Chapek, who came over as CEO of Disney in February 2020, just as the COVID-19 epidemic was causing park closures and tourist limitations. He will be replaced by this individual.

According to Neil Wilson, an analyst working for Markets.com, “Perhaps what’s necessary is an elderly hand on the tiller.” Disney has been investing billions of dollars in an effort to compete with major competitor Netflix Inc (NFLX.O) and is attempting to restore its share price.

More than forty percent of the stock’s value had been wiped off since the beginning of the year, trailing behind the year-to-date decline of about seven percent in the Dow Jones Industrial Average. During Chapek’s tenure as CEO, the company suffered a loss of over one third of its worth.

Investors were underwhelmed by Disney’s quarterly earnings report this month, which revealed rising losses at the company’s streaming media segment, which includes Disney+. The day after the release of the fourth-quarter results report, the share price fell to a level not seen in the last 20 years. continue reading

Despite increases in subscriber numbers, the streaming industry posted a quarterly loss of about $1.5 billion, which is more than twice as large as the loss recorded the year before. Since its inception in 2019, the business has not yet generated a profit, and Disney has said that it anticipates Disney+ to become profitable in the fiscal year 2024.

In August, Loeb started pressing for reforms, such as spinning off the ESPN sports television network and speeding up the planned buyout of Hulu from Comcast Corp., which is a minority stakeholder. After some time had passed, the investor stated that he now had a greater understanding of the significance that ESPN has for Disney. Additionally, Third Point insisted that Disney update its board of directors and was successful in reaching a settlement with the corporation in September that resulted in the appointment of Carolyn Everson, a former executive at Meta.

According to a person with knowledge of the situation, Trian Fund Management LP, which was co-founded by Nelson Peltz, purchased more than $800 million worth of Disney shares in the days that followed the release of its dismal earnings report. The WSJ was the first publication to mention Trian’s interest.

According to the source, Trian is of the opinion that Iger should not be allowed to regain control of the business, and the firm has shown interest in obtaining a board seat as it continues to exert pressure on the entertainment giant to make operational changes and reduce expenses.

According to a report in the WSJ, Trian’s interest, which falls below the 5% requirement for disclosure, is not as substantial as the company would want it to be but is expected to expand regardless of the market circumstances.

A request for comment on Trian was sent to both Disney and Trian, but neither company responded with their thoughts.