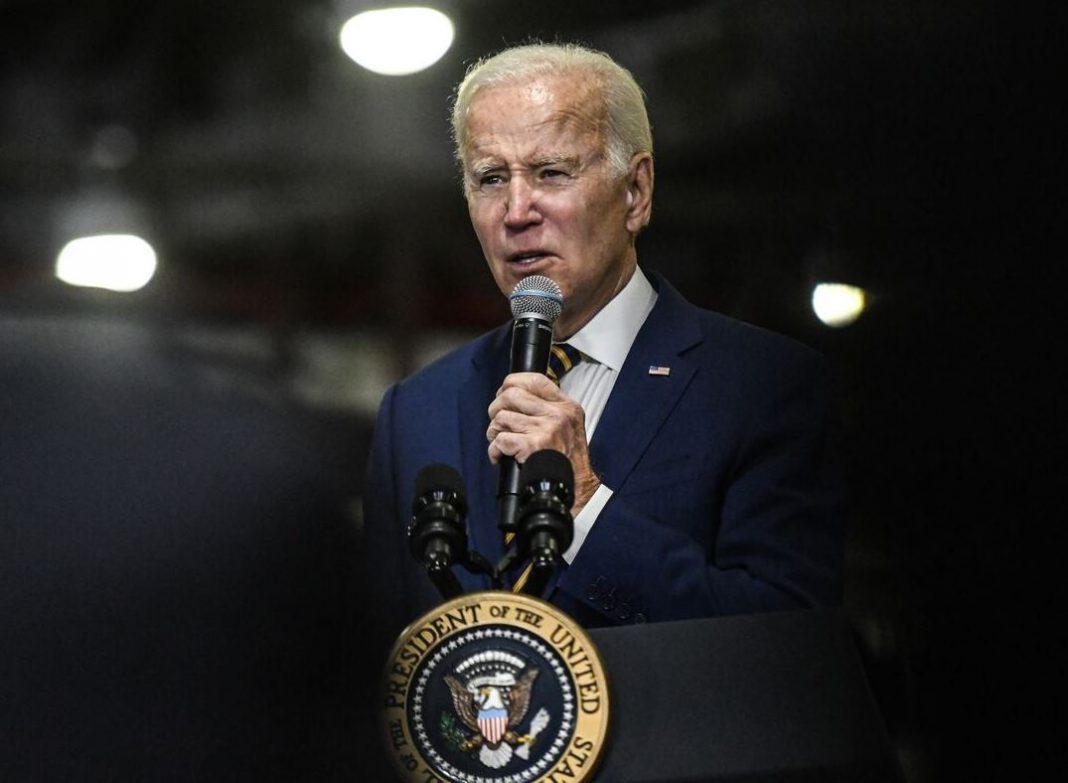

President Joe Biden is set to propose a tax hike on wealthy individuals, including a 25% tax rate on billionaires‘ investment gains, as part of his efforts to fund trillions of dollars in new federal spending. The proposal, which is expected to be outlined in detail in the coming weeks, aims to increase revenue for the government by targeting high-income earners and large corporations.

Under the plan, individuals earning over $1 million per year would see their capital gains tax rate increase to 39.6%, up from the current rate of 20%. In addition, the proposed plan would eliminate a tax break that allows individuals to avoid paying capital gains taxes on assets held until death.

Biden’s tax proposal would also increase the top marginal income tax rate to 39.6%, up from the current rate of 37%, and would impose a 3% surtax on those earning over $5 million annually. The White House has estimated that the proposed changes to the tax code would raise $2.5 trillion in revenue over the next decade.

The tax proposal is part of a broader effort by the Biden administration to fund investments in infrastructure, education, and social programs. The administration has already proposed a $2 trillion infrastructure plan, which would be funded by a corporate tax hike. The new tax proposal would help pay for the American Families Plan, which includes investments in childcare, education, and paid leave.

The tax plan is likely to face opposition from Republicans, who have argued that tax hikes would hurt the economy and discourage investment. Some business groups have also criticized the plan, arguing that it would make the United States less competitive by driving away investment.

The proposal has received support from progressive Democrats, who have long pushed for higher taxes on the wealthy to fund social programs. Senator Elizabeth Warren, a vocal proponent of wealth taxes, tweeted her support for the plan, saying that it was “time for the ultra-rich to pay their fair share.”

It remains to be seen whether the tax proposal will be included in the final legislation. Democrats have a narrow majority in both the House and the Senate, and some moderate Democrats have expressed concern about the impact of tax hikes on small businesses and family farms.

In any case, the proposal represents a significant shift in tax policy, with the Biden administration seeking to use the tax code to address income inequality and fund investments in social programs. The coming weeks will see intense debate over the details of the proposal and its potential impact on the economy and American society.