Sandy Carter announced her departure from her position as vice president of Amazon’s cloud computing section in a LinkedIn post earlier this month, stating that she would be joining a crypto technology startup. She also supplied a link to a listing of available opportunities at the start-up.

Over 350 individuals had applied for positions at Unstoppable Domains in less than two days, according to her, with many of them coming from the world’s largest online corporations. It offers website addresses that are hosted on the blockchain, which is the distributed ledger system that serves as the foundation for cryptocurrencies.

Some of which pay millions of dollars in annual compensation — to pursue what they believe to be a once-in-a-generation opportunity in blockchain technology. They referred to crypto as the next big thing, which is a catch-all term that encompasses digital currencies such as Bitcoin as well as goods such as nonfungible tokens, or NFTs, that are based on blockchain technology.

Dogecoin, a digital token based on a dog joke, has become a popular investment vehicle in Silicon Valley, with tales of individuals making life-changing fortunes off of apparently ludicrous crypto purchases. This year, the value of Bitcoin has climbed by almost 60%, while the value of Ether, the cryptocurrency linked to the Ethereum blockchain, has surged by more than fivefold.

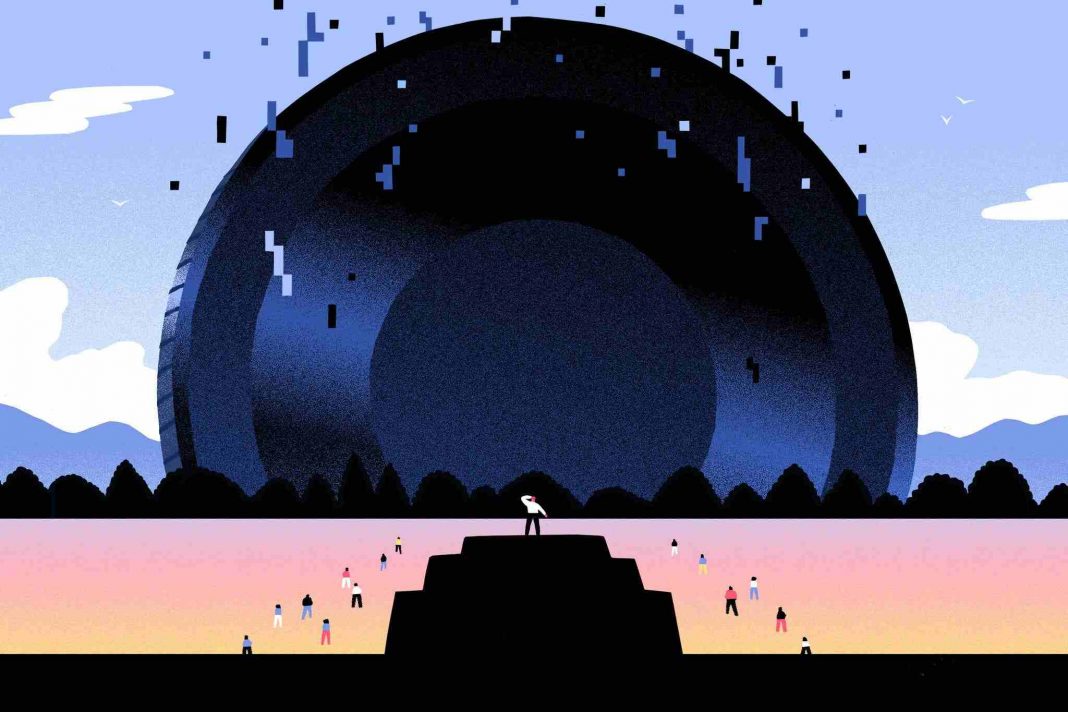

Nevertheless, behind the speculative frenzy, a rising number of the IT industry’s brightest and greatest are anticipating a revolutionary moment that will occur once every few decades and will reward those who are able to recognise the seismic shift ahead of the rest of the globe. Those who believe in cryptocurrency draw historical similarities to how personal computers and the internet were once derided before upending the status quo and creating a whole new generation of millionaires.

Investors, too, have flocked to the region. According to PitchBook, a company that analyses private investments, they have put more than $28 billion into global crypto and blockchain start-ups this year, more than four times the entire amount invested in the same sector in 2020. More than $3 billion has been invested in non-financial technology startups alone.

According to Sridhar Ramaswamy, chief executive of search engine start-up Neeva and a former Google employee, who competes with crypto startups for talent, “there is a tremendous sucking sound coming from crypto.” In some ways, it seems like the 1990s and the beginning of the internet are happening again. The time is just too early, the environment is too chaotic, and the future is too full of possibilities.”

Some argue that cryptocurrency, which has also been renamed as the less ominous web3, is no different from other speculative booms like as subprime mortgages or the tulip frenzy of the 17th century. They claim that a large part of the frenzy is motivated by a desire to make rapid money by trading an asset class that seems to be based on online jokes on a regular basis.

However, a rising number of true believers think that cryptocurrency has the potential to revolutionise the world by enabling a more decentralised internet that is not controlled by a small number of corporations. While such possibilities have existed since the inception of Bitcoin in 2009, it was only this year that crypto goods such as NFTs made their way into the public. As a result, the outflow from Big Tech organisations into the crypto sector has been accelerated.

The appeal of cryptocurrency has proven to be so seductive that some of the world’s largest IT businesses are fighting to keep personnel. In recent months, the company’s chief executive, Sundar Pichai, and his top deputies have become increasingly concerned about retaining employees, including preventing them from defecting to crypto companies. The issue has become so pressing that it has become part of the executive agenda discussed every Monday by Pichai and his deputies, according to two people with knowledge of the discussions.

In contrast to Meta, which has embraced cryptocurrency, Google has been hesitant to join the trend. However, when Surojit Chatterjee, a vice president at Google, departed the firm last year to become the chief product officer of Coinbase, one of the world’s biggest cryptocurrency exchanges, Google workers got to see bitcoin’s potential firsthand.

Anxiety over the control and domination of the major computer businesses by their own workers has also contributed to a portion of the brain drain towards cryptography. Many people had joined Google, Facebook, and other large corporations in order to start something fresh, only to be greeted with bureaucracy and the negative consequences of working for such behemoths.

While employees at tech start-ups often take a lower pay in the expectation that the company’s stock would soar one day, employees at cryptocurrency start-ups are supplied with “liquidity,” or the chance to cash out their shares, far earlier in the process. A common way in which they may do so is to trade in the cryptocurrencies issued by their respective companies, according to Dan McCarthy, a recruiter for the investment firm Paradigm who has written on the potential benefits of crypto start-ups for IT employees.