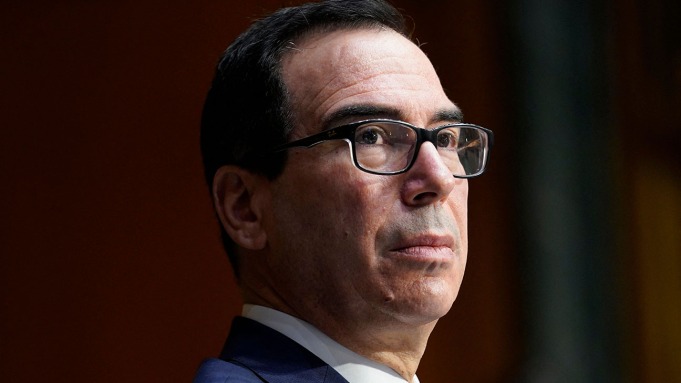

Former Trump administration Treasury Secretary Steven Mnuchin is contemplating a return to media investment, but he will likely focus on digital material rather than the conventional theatre films he funded before to joining the administration.

Treasury Secretary Steven Mnuchin has raised $2.5 billion for his private equity fund, Liberty Strategic Capital, and is looking for investments in the technology sector, including fintech and cybersecurity. The fund’s first investment, a $275 million raise by cybersecurity firm Cybereason, was announced in conjunction with the fund’s first investment, which was announced in conjunction with the fund’s first investment.

Mr. Mnuchin, a former Goldman Sachs banker, film investor, and hedge fund manager, is now using the knowledge — and connections — that he gained while working for the Treasury Department to continue to grow his fortune. His net worth was projected to be $400 million at the time of his appointment to the Treasury position in 2017.

Concerns have been raised regarding the size of Mr. Mnuchin’s fund and its assets in nations where he visited while serving as Treasury Secretary, raising the possibility that he exploited his government position to benefit himself.

A watchdog organisation, Citizens for Responsibility and Ethics in Washington, filed a lawsuit this year demanding details regarding the costs of Mr. Mnuchin’s travel to the Middle East, where he visited frequently while in office. Mr. Mnuchin has not responded to the complaint.

He oversaw the Trump administration’s economic policy as Treasury Secretary, including helping to design the Republican tax cuts that were implemented in 2017 and representing the United States in a number of foreign forums. After significant lobbying pressure from the hedge fund and private equity industries, the tax legislation eventually did not remove the unique classification for “carried interest,” which favours hedge fund managers and private equity executives.

Jacob J. Lew and Timothy F. Geithner, former Treasury Secretaries, have both gone on to work in private equity after leaving government service.

A number of former government officials have also been recruited to work for Liberty in a variety of roles, according to Mnuchin. David Friedman, President Donald Trump’s ambassador to Israel, is in charge of the company’s Tel Aviv headquarters, while former Chairman of the Joint Chiefs of Staff Joseph Dunford is acting as an advisor to the organisation.