On Thursday, objections to a comprehensive plan that might cost the government hundreds of billions of dollars were turned down by both a federal court in Missouri and Justice Amy Coney Barrett, which gave a double blow to opponents of President Biden’s student debt relief schemes.

This action was initiated by six states with Republican-led governments. According to the allegations made in the lawsuit, President Joe Biden violated a federal law that was passed in 2003 and gives the Secretary of Education the authority to alter student aid programmes “in connection with a war or other military operation or national emergency.” This provision of the law gives the Secretary of Education this authority.

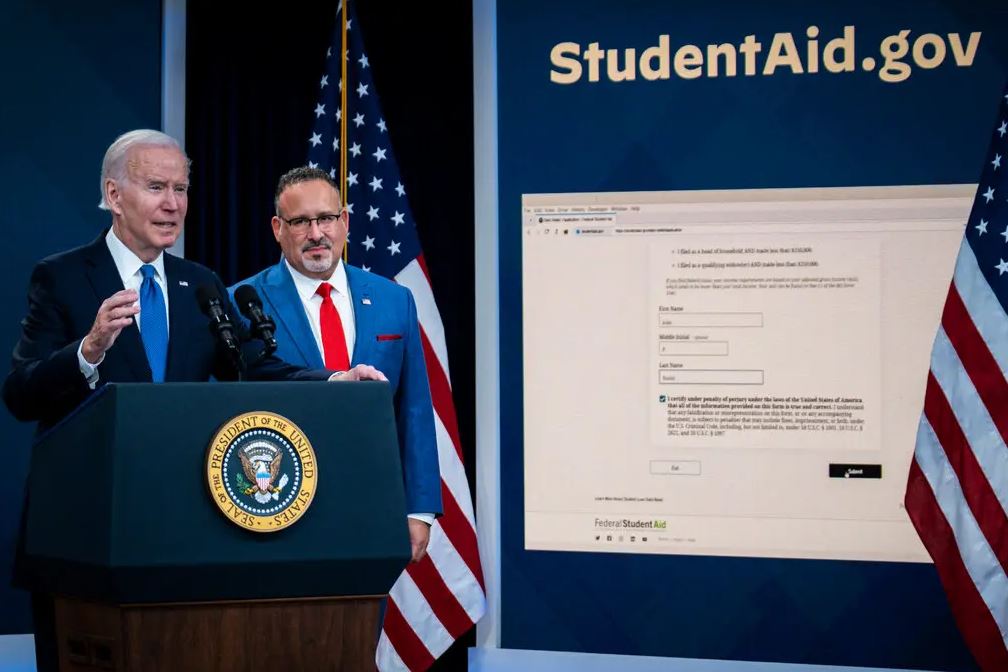

The idea forgives a total of $20,000 in debt for those who earned Pell grants for families with low incomes and $10,000 for people whose annual income is less than $125,000 or whose household income is less than $250,000. Last month, the nonpartisan Congressional Budget Office estimated that the plan would have a price tag of $400 billion, and the Education Department followed a few days later with a similar estimate of $379 billion over the life of the programme. Both estimates are for the total amount that will be spent on the plan.

The action was filed by the states of Nebraska, Missouri, Arkansas, Iowa, and Kansas, and Judge Autrey, who was chosen by George W. Bush as president, did not make a decision about the most significant issue in the case. Instead, he said that the states had not been injured to the extent that would give them the legal right to file a lawsuit.

It was believed that the action brought by the states posed the most major challenge to Mr. Biden’s proposal, and the decision made by Judge Autrey made it possible for the government to begin discharging debts as early as Sunday. Since the application platform was made available late last week, more than 12 million individuals have used it to submit requests to have their debts forgiven.

There are still a number of pending legal challenges, one of which is a lawsuit supported by the Job Creators Network, which is a company owners’ trade association with conservative leanings. On Tuesday, a federal court in Fort Worth is going to hear arguments on the parties’ request for an injunction, which is set to take place there.

A different challenge to the debt relief scheme, which was brought forward by a taxpayers’ group in the state of Wisconsin, was dismissed by Justice Barrett on Thursday as a second piece of noteworthy news to come out of the day.

As is customary for the court when rendering decisions on emergency applications, Justice Barrett dismissed the association’s challenge without offering any explanation. She handled the situation on her own, without bringing the application before the whole court, and she did not inquire for a response from the administration. Both of these actions were red flags pointing to the fact that the application did not have a strong legal foundation.

In spite of the fact that Justice Barrett did not explicitly state the reason for her decision, it is quite probable that the application was turned down because the Brown County Taxpayers Association seemed to be without standing.

The association’s complaint had been dismissed by Judge William C. Griesbach of the Federal District Court in Green Bay, Wisconsin, without the judge addressing the question of whether or not Mr. Biden had behaved properly. Instead, Judge Griesbach, who was chosen by Mr. Bush, came to the conclusion that the group had not shown that it had the legal right to bring the lawsuit.

Even if the challenger could demonstrate that they were entitled to bring their case, Judge Griesbach questioned whether it would be appropriate to issue an order to terminate the programme. According to what he said, those who acquire debt relief may once again be accountable for obligations that have been forgiven if the administration operated in an unconstitutional manner.

A panel of three judges from the United States The Court of Appeals for the Seventh Circuit, which has its headquarters in Chicago, declined to review an unsigned ruling that did not provide any explanation for its decision. Justice Barrett is in charge of that circuit, thus it is appropriate to direct any urgent appeals concerning the decisions of that circuit to her in the first instance.

In its application, the association stated that the amounts involved justified relaxing the standing criteria, and that this was justified based on the standing rules. According to a statement that was written by the association’s legal representatives, “We are seeing a gigantic growth in the national debt done by a blatant contempt for constraints on the constitutional spending power.”

In addition to this, they said that “the premise that a president may unilaterally absolve debt owing to the U.S. Treasury via administrative fiat, and the fact that no one has standing to oppose him, constitutes a danger to the fundamental underpinnings of a constitutional republic.”