The Biden administration announced new, stricter limits on the sale of advanced semiconductors by U.S. companies to China, building upon the restrictions introduced in October of the previous year to curb China’s advancements in supercomputing and artificial intelligence.

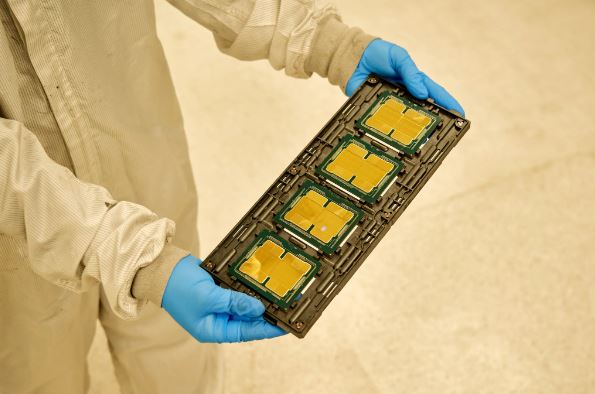

These new rules are expected to largely halt shipments of advanced semiconductors from the United States to Chinese data centers, where they are used to develop artificial intelligence models. Companies seeking to sell advanced chips or the manufacturing equipment required to make them to China will now need to notify the U.S. government of their intentions or obtain a special license.

To prevent U.S. chips from making their way to China through third-party countries, chip makers will also be required to obtain licenses for shipments to dozens of other nations subject to U.S. arms embargoes.

The Biden administration contends that China’s access to such advanced technology poses a threat, as it could be used in military applications, including guiding hypersonic missiles, establishing advanced surveillance systems, and decoding sensitive U.S. information. Experts in the field of artificial intelligence have expressed concerns about the potential misuse of this technology, highlighting existential risks to humanity.

However, these restrictions may also impact Chinese companies working on commercial artificial intelligence applications such as chatbots, potentially affecting firms like ByteDance (parent company of TikTok) and Baidu. In the long term, these limitations could weaken various sectors of China’s economy, as artificial intelligence is transforming industries ranging from retail to healthcare.

The new restrictions could also affect sales of U.S. chip makers like Nvidia, AMD, and Intel, as some of these companies derive up to a third of their revenue from Chinese customers. These chip makers have lobbied against the introduction of stricter restrictions.

The rules will exempt chips intended solely for commercial purposes, such as smartphones, laptops, electric vehicles, and gaming systems. Most of these rules will take effect in 30 days, with some coming into force sooner.

A spokesperson for Nvidia stated that the company complies with all applicable regulations and does not anticipate significant short-term financial consequences due to worldwide demand for Nvidia’s products.

The Biden administration maintains that the tougher restrictions are a response to circumvention attempts by some entities and the latest developments in generative artificial intelligence. These breakthroughs have provided regulators with a better understanding of how large language models are being developed and utilized.

Gina M. Raimondo, the U.S. Secretary of Commerce, stated that the changes were implemented to enhance the effectiveness of these rules. She anticipates that these rules will be updated at least annually to keep pace with technological advancements. Raimondo reaffirmed that the main goal remains limiting China’s access to advanced semiconductors with potential applications in artificial intelligence and critical computing for military purposes.

The introduction of these stricter rules could strain U.S.-China relations, particularly as the Biden administration seeks to mend ties and prepare for a potential meeting between President Biden and Chinese leader Xi Jinping in California in the coming month.

The Biden administration has been focused on addressing China’s increasing dominance in cutting-edge technologies, investing in new chip manufacturing facilities in the United States. Simultaneously, the administration aims to impose stringent but targeted restrictions on technology exports to China that may have military applications while allowing other trade to continue. U.S. officials describe this strategy as safeguarding American technology with a “small yard and high fence.”

Nvidia has stated that roughly 20% to 25% of the company’s data center revenue is generated from China, including other products in addition to artificial intelligence chips. While there may be potential for Nvidia to compensate for losses by meeting growing global demand for its chips in artificial intelligence applications, concerns about the impact of performance limitations on a wider range of Nvidia chips led to a more than 3% drop in the company’s stock price.

The U.S. administration also placed two Chinese chip design companies, subsidiaries of Moore Threads Technology and Biren Technology, on an “entity list.” This action necessitates that U.S. companies receive special permission to ship materials to these entities. The United States is also establishing a “gray list” requiring manufacturers of certain less advanced chips to notify the government when selling them to China, Iran, and other countries under U.S. arms embargoes.

These new rules do not seem to restrict Chinese firms’ access to foreign cloud services provided by Amazon and Microsoft. There had been discussions about clamping down on this business recently, as Chinese firms had used these services as a backdoor to access advanced artificial intelligence chips outside of China. However, any such measure may come later in the form of an executive order.

Julian Evans-Pritchard, head of China economics at Capital Economics, stated that the full impact of these controls would become more apparent as non-Chinese companies introduce advanced versions of their current products.

The strict limitations on advanced semiconductor sales to China are part of the United States’ broader effort to address growing concerns about the misuse of artificial intelligence technology and its impact on national security. The rules aim to balance the need to protect sensitive technology with the desire to encourage innovation and maintain economic growth.